Authors & Contributors

How will shifts in US trade policy disrupt relations with US global trading partners?

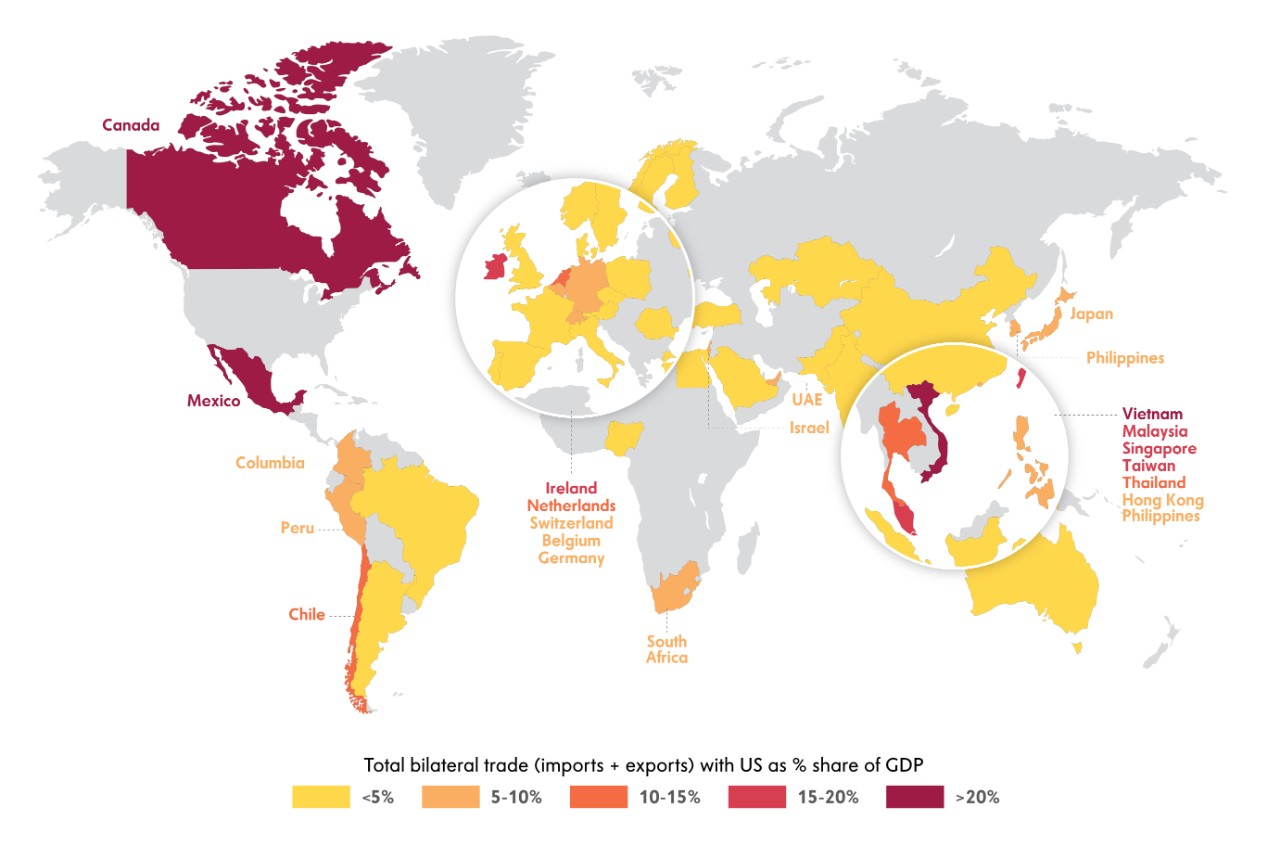

The new US administration has signaled that tariffs will be an important part of their policy toolkit. While the exact specifics of these tariffs remain cloudy, the chance of them in some form is high, including a possible universal tariff hike across all trading partners. Tariffs act by raising the price of imports, dampening consumer demand for foreign goods among other effects. This would ripple through economies, with implications for growth, inflation, monetary policy and exchange rates. The more a country relies on trade with the US, the more sensitive its economy would be to swings in US trade policy. Using data from the US Census Bureau and International Monetary Fund, we look at the world’s 50 largest economies and assess who faces the greatest risks from a potential universal tariff imposed by the US on its trading partners.

Mapping the Impact of Tariffs

Note: Bilateral trade is total sum of annual imports and exports according to the US Census Bureau. GDP is nominal GDP in current USD from the IMF's World Economic Outlook Report. Observation period is 2023.

At the top of the most vulnerable list are Mexico and Canada. Many industries, jobs and investments are oriented around trade between the United States-Mexico-Canada Agreement (USMCA, formerly NAFTA) members and tariffs would present challenges for the free trade agreement, which is up for review in 2026. Trade flowing between Mexico and the US accounts for approximately 45% of Mexico’s GDP, with $475 billion of goods exported to the US in 2023, which totals 75% share of its total exports. In Canada, trade with the US represents 36% of its GDP and $419 billion of goods. From automobiles and televisions to agricultural products and energy, supply chains for many products that reach the US consumer market cross between the three countries.

Next up is Vietnam, where vulnerability has been intensified in recent years by Chinese producers shifting into the southeast Asian country as a way of getting around existing tariffs put in place on China during the first Trump administration and more recently under President Biden’s term.

Smaller tech-dependent economies like Ireland, Taiwan and Malaysia would be deeply impacted. Important manufacturing hubs like Japan and South Korea also heavily rely on trade with the US and around the Pacific Rim.

Germany, the manufacturing engine of Europe, and its northern and central neighbors are also at risk. The German manufacturing sector has been struggling recently given headwinds of higher regional energy prices and slowing growth in China.

China stands out as facing the harshest tariff rate hike and has been in the US’ crosshairs since tariffs were first imposed in 2018 during the first Trump administration due to alleged unfair trade practices, security concerns and intellectual property theft. While China still sends a massive volume of exports to the US, it has diversified its trade away from the US and deepened trading relationships throughout emerging markets that are hungry for its products. US goods imports from China declined to $427 billion in 2023 from a $538 billion peak in 2018 when Trump’s initial tariffs were just going into effect. With the increasing rate of tariffs, the size of that trading relationship should continue to shrink.

Another Way to View Tariff Impacts: Bilateral Goods Trade

Total Bilateral (Imports + Exports) Goods Trade With US, as % Share of GPD

Note: Bilateral trade is total sum of annual imports and exports according to the US Census Bureau. GDP is nominal GDP in current USD from the IMF's World Economic Outlook Report. Observation period is 2023. Larger bilateral goods trade implies greater sensitivity to potential US tariffs.

A trade war will likely not stop after the opening US salvo and further escalation is a downside risk to global growth. Countries affected will likely retaliate with tariffs of their own and possible export restrictions of key products. Central banks may need to boost monetary policy support to offset the negative shock to aggregate demand, especially in the most exposed countries. Shifting interest rate differentials between countries will have implications for exchange rates.

Follow along with us this year as we provide updates on this key theme as it plays out across the global economy.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All investments involve risk, including the possible loss of principal. Certain investments have specific or unique risks. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be, interpreted as recommendations. Charts are provided for illustrative purposes and are not indicative of the past or future performance of any BNY product. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with Mellon Investments Corporation (MIC), do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Investors cannot invest directly in an index.