Authors & Contributors

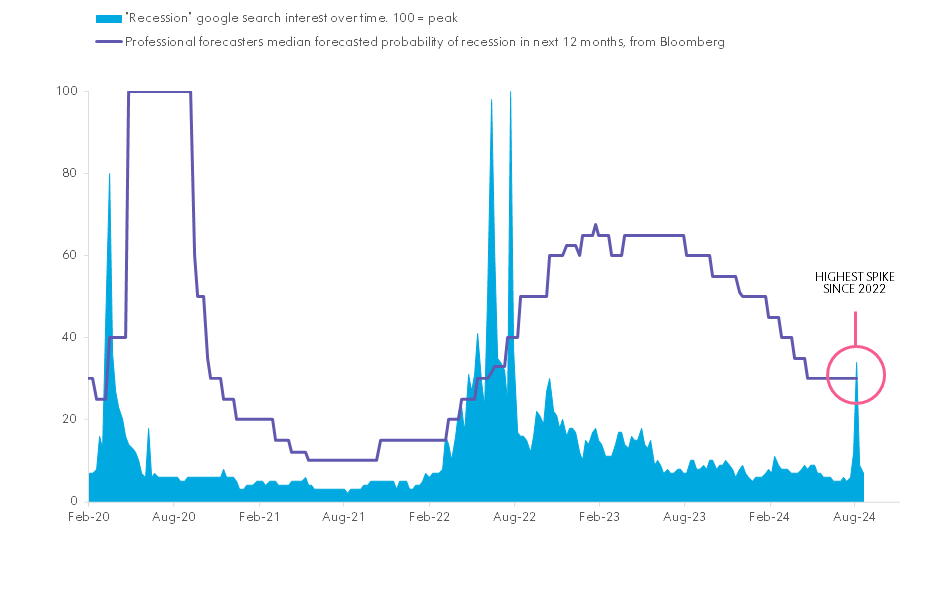

The Google search for “recession” has spiked to its highest level since the 2022 recession panic.

Impending Recession or Another False Alarm?

Source: Bloomberg and Google, accessed August 20th, 2024

Recent data show that the US jobs market has cooled in recent months, raising uncertainty over the near-term resilience of the economy. In the data for July, the unemployment rate rose for the fourth straight month to 4.3%, causing a sudden wave of anxiety that the economy is entering a recession. This was reflected in a significant spike in Google searches for “recession”, which peaked in 2022 when widespread recession fears proved to be a false alarm.

We do not think that recent cooling in the labor market forebodes a recession hiding around the corner. Data on the broader economy suggests continued strength in domestic spending and minimal concern around industrial activity—nothing that hints at the US economy heading for a cliff.

A notable aspect of the July employment report was that the rising unemployment rate triggered the Sahm Rule. The Sahm Rule identifies signals related to the start of a recession and is triggered when the three-month moving average of the unemployment rate rises 0.5% or moves more relative to its lowest point during the previous 12 months.

However, there’s a few reasons to remain calm and take this measure with a grain of salt. First, a large factor behind the rising unemployment rate is a growing labor force. The labor force is powered by strong immigration and an increasing participation rate for prime-age workers (25 to 54 years old) which reached 84% in July, its highest level since 2000. On the demand side, the labor market is still creating jobs on net, despite a slower pace. Second, the rise in the unemployment rate has been shallower than in any recession since 1960.

While we don’t see signs of imminent recession, we do see significant evidence that the labor market has cooled off. Job openings have fallen, workers are more reluctant to quit, and the average spell of unemployment is longer. The Federal Reserve (Fed) shares this view, with Chair Powell telling us in his Jackson Hole speech that “the labor market has cooled considerably from its formerly overheated state” and that they “do not seek or welcome further cooling in labor market conditions.” This adds to the Fed’s confidence that it can dial back some of its monetary policy restriction. A cooling job market and positive news on inflation has opened the door for the Fed to begin cutting rates at its September Federal Open Market Committee meeting. We anticipate a 25-basis-point cut followed by like-sized moves once a quarter through 2026.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All investments involve risk, including the possible loss of principal. Certain investments have specific or unique risks. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be, interpreted as recommendations. Charts are provided for illustrative purposes and are not indicative of the past or future performance of any BNY product. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with Mellon Investments Corporation (MIC), do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Investors cannot invest directly in an index.