Authors & Contributors

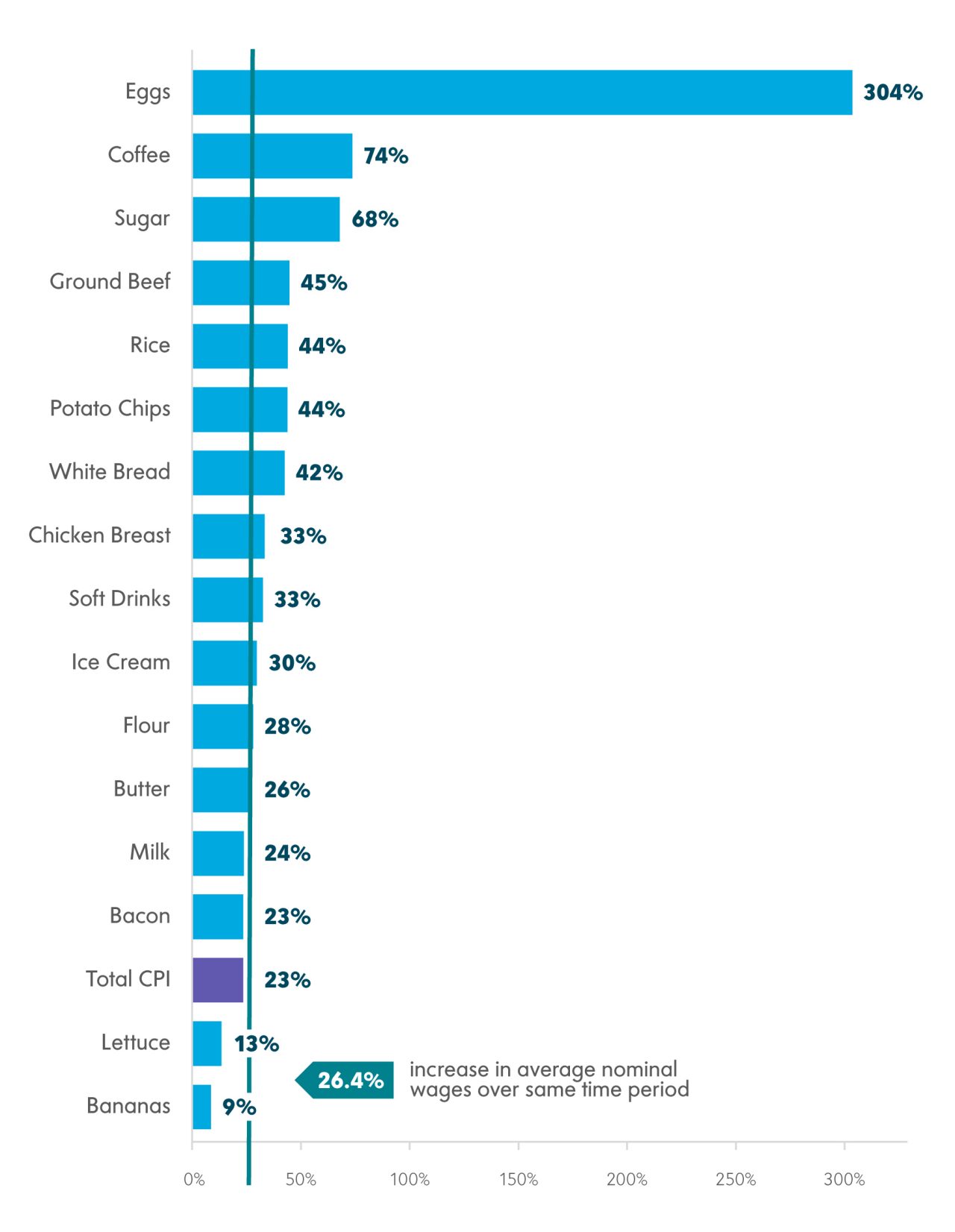

Due to the avian flu, egg prices have increased 304% since January 2020.

Did we think egg prices were high last year? Unfortunately, it has only gotten worse. Egg prices are on the rise, once again, with consumers paying an average of almost $6 per dozen, a record high and double the price from about a year ago. An outbreak of avian flu has upended the industry, leading to supply shortages that have pushed prices up 304% since January 2020. Seasonal demand is increasing prices further as stores stock up for Easter and holiday baking.

Eggs aren’t the only item in the higher-price basket. Many grocery staples have prices far outpacing average inflation and wage growth this decade, a result of factors like supply disruptions, more extreme weather patterns and higher input costs. For instance, sticker-shock might result from pairing those eggs with a cup of coffee at breakfast. Weather issues in top coffee bean producing regions like South America contributed to difficult growing seasons and increased coffee bean prices. Sugar production has faced similar weather-related disruptions. Unfortunately, relief does not come from meals later in the day. Increases in average ground beef, bread and rice prices have almost doubled the rate of inflation over the past five years. Many shoppers are left wondering when they will catch a break.

Rise and Shine

% price change between January 2020 and February 2025

Source: US Bureau of Labor Statistics

To put food price inflation in broader context, the food category has added a steady 0.3 percentage points per month to the annual consumer price index (CPI) inflation over the past 12 months. While overall inflation steadily declined in 2024, helped by falling goods and energy prices, it’s been more stubborn in recent months. Inflation rose 2.8% year-over-year in February, down just slightly from January's 3% pace and faster than September's 2.4%. Sticky services price inflation, which makes up a substantial 64% weight of the overall index, remains elevated despite cooling slightly. Goods and energy prices have not been a significant source of inflation recently, but that could reverse with a potential ratcheting up of tariffs.

The recent increase in inflation, among other factors like uncertainty around the impact of potential changes in trade and immigration policy, led the Federal Reserve (Fed) to press pause on rate cuts at its January meeting. At the meeting, the policy rate target range was left steady at 4.25% to 4.5% after being lowered 100 basis points (bps) since September. By the time of Fed Chair Powell’s appearances on Capitol Hill for the semi-annual report on monetary policy in midFebruary, Fed guidance became more explicit: "With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance." This suggests that, while the Fed is leaning toward a lower policy rate and momentum may carry them forward, action is tabled for later in the year. Fed policy can’t directly influence the price of eggs, which may not come down until the industry’s supply issues are resolved. Interest rates and the price of eggs could both be higher for longer. In short, consumers may want to consider an alternative to dying eggs this Easter.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All investments involve risk, including the possible loss of principal. Certain investments have specific or unique risks. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be, interpreted as recommendations. Charts are provided for illustrative purposes and are not indicative of the past or future performance of any BNY product. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with Mellon Investments Corporation (MIC), do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Investors cannot invest directly in an index.