Authors & Contributors

After years of inflation concerns, will the recent boost in consumption lead us in the right direction?

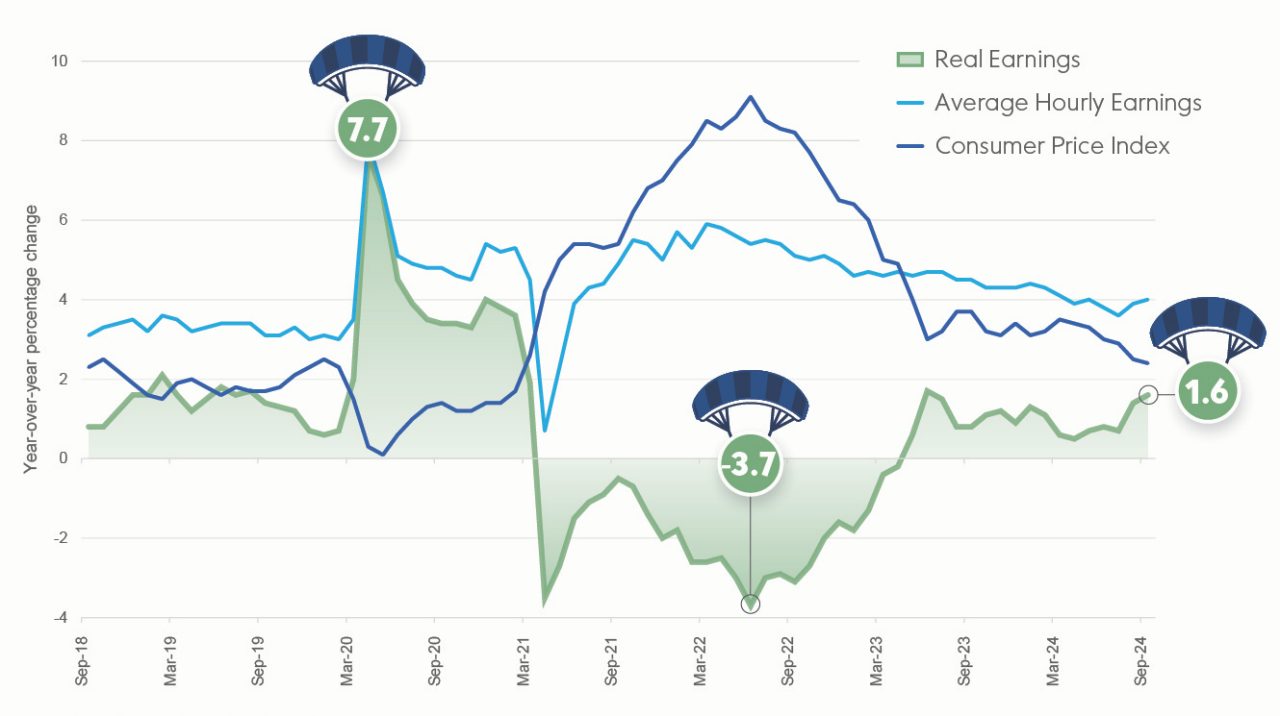

Real Earnings are Solid

Source: Bureau of Labor Statistics (BLS)

The closely watched headline numbers in the September jobs report surpassed expectations. The 254,000 net jobs were created faster than anticipated along with upward revisions to July and August jobs reports. The unemployment rate also ticked down for the second month to 4.1%.

An interesting thread was the increase in average hourly earnings growth, with the annual pace accelerating to 4%. This is positive news for the US economy as wages drive consumption, which makes up over two-thirds of US economic output. With inflation cooling to 2.4% in the latest reading, real income growth is back in positive territory, boosting purchasing power. This is welcomed after a challenging period in 2022 and 2023 when inflation eroded at income gains.

Between this month’s strong data, Jay Powell’s hints at a gradual pace of easing, and recent rise in oil prices you would think another jumbo 50 basis point (bps) cut is unlikely anytime soon. After the employment data, rates markets dialed back expectations for Fed easing. However, fed fund futures now price back-to-back 25 bps cuts in November and December. Is anyone talking about a pause yet?

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All investments involve risk, including the possible loss of principal. Certain investments have specific or unique risks. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be, interpreted as recommendations. Charts are provided for illustrative purposes and are not indicative of the past or future performance of any BNY product. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with Mellon Investments Corporation (MIC), do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Investors cannot invest directly in an index.