Authors & Contributors

The contest on Capitol Hill to be the most visibly responsive continues apace, with a Congress that had not accomplished much in the prior three years passing three relief packages in as many weeks. Some legislators are promising more to follow. The Senate version of the Coronavirus Aid, Relief and Economic Security (CARES) Act aggregates to $2.1 - $2.2 trillion (depending on scoring of imprecise legislation) of mostly front-loaded impetus.

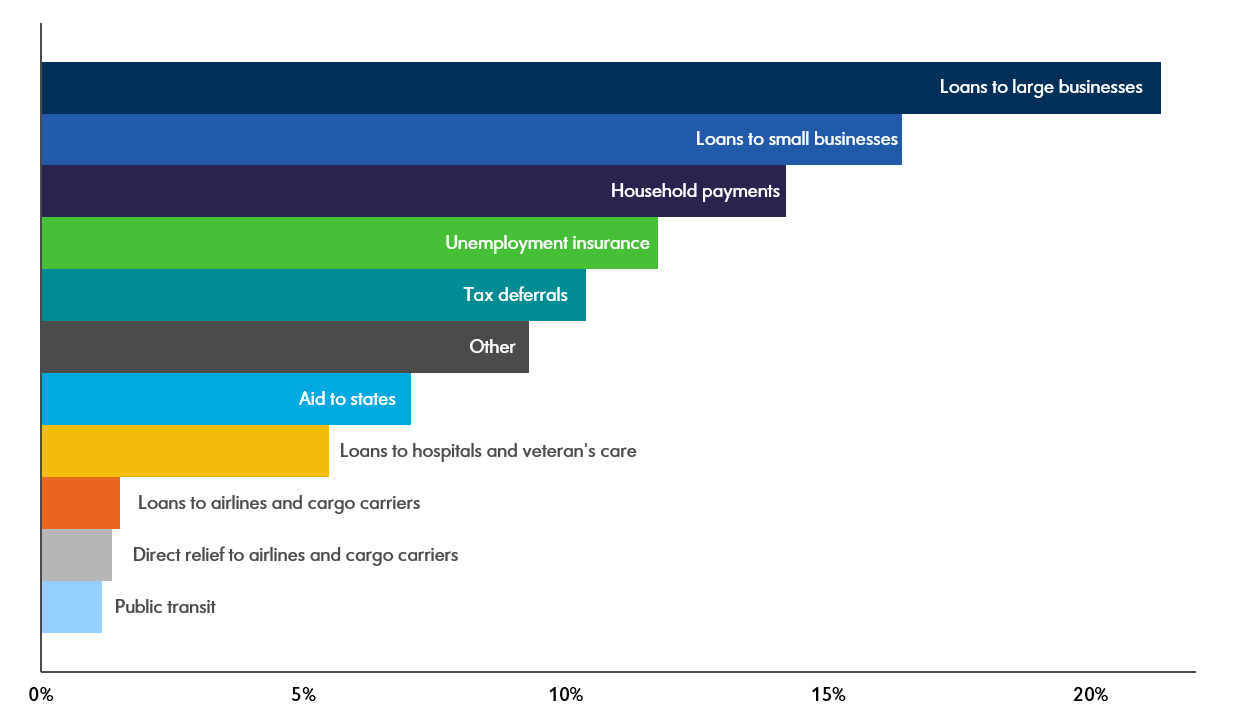

The CARES Act of 2020

Share of Total

Source: Wall Street Journal, March 29, 2020.

Below are the key provisions of the 2020 CARES Act.

Unemployment insurance (UI) for workers is expanded to include a $600 per-week increase in benefits for up to four months and federal funding of UI benefits provided to those not usually eligible for them, such as the self-employed, independent contractors and those with limited work history. The federal government will fund an additional 13 weeks of unemployment benefits through December 31, 2020 after workers have run out of state unemployment benefits.

$350 billion is allocated for the Paycheck Protection Program to help small businesses (those with fewer than 500 employees). Loans may be forgiven if a firm uses the loan for payroll, interest payments on mortgages, rent and utilities.

For individual taxpayers, there is a Recovery Rebate that provides a $1,200 refundable tax credit for individuals ($2,400 for joint taxpayers). Additionally, taxpayers with children will receive a flat $500 for each child. The rebate begins to phase out at $75,000 for singles, $112,500 for heads of household and $150,000 for joint taxpayers. The Tax Foundation estimates that the rebates increase after-tax income by about 2.6 percent, ranging from 16.3 percent at the lowest quintile and dropping to 1.9 percent for the 80th to 90th percentiles.

The Act waives the 10 percent early withdrawal penalty on retirement account distributions for taxpayers facing virus-related challenges.

Employers may contribute up to $5,250 annually toward student loans, and the payments would be excluded from an employee’s income.

It also includes a variety of business tax provisions:

- Employers are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 during the crisis. It would be available to employers whose businesses were disrupted due to virus-related shutdowns and firms experiencing a decrease in gross receipts of 50 percent or more when compared to the same quarter last year. The credit is available for employees retained but not currently working due to the crisis for firms with more than 100 employees, and for all employee wages for firms with 100 or fewer employees.

- Employer-side Social Security payroll tax payments may be delayed until January 1, 2021, with 50 percent owed on December 31, 2021 and the other half owed on December 31, 2022. In the interim, the Social Security Trust Fund will be backfilled by general revenue.

- Firms may take net operating losses (NOLs) earned in 2018, 2019, or 2020 and carry back those losses five years. The NOL limit of 80 percent of taxable income is also suspended, so firms may use NOLs they have to fully offset their taxable income.

The Treasury’s Exchange Stabilization Fund is more than quadrupled, to$454 billion, which provides first-loss protection to the Federal Reserve in emergency lending to businesses, states and cities. Additionally, this includes:

- $25 billion in lending for airlines

- $4 billion in lending for air cargo firm

- $17 billion in lending for firms deemed critical to U.S. national security

Firms taking loans must not engage in stock buybacks for the duration of the loan plus one year, and must not cut employment levels as of March 24, 2020. Loans also come with terms limiting employee compensation and severance pay. Emergency lending will be overseen by a Congressional Oversight Commission and a Special Inspector General.

There are several health provisions to address the coronavirus crisis, including addressing supply shortages, coverage of diagnostic testing for the virus, support for health- care providers, improving telehealth service access and flexibility, encouragement for the creation of drugs to treat the virus, strengthening related Medicare and Medicaid provisions, and providing support for educational institutions.

Finally, the Act includes$150 billion in a Coronavirus Relief Fund for state and city government expenditures incurred due to dealing with the coronavirus public health emergency. The Fund would be allocated by population proportions, with a minimum of $1.25 billion for each state.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Mellon Investments Corporation (“Mellon”) is a registered investment advisor and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). Any statements of opinion constitute only current opinions of Mellon, which are subject to change and which Mellon does not undertake to update. This publication or any portion thereof may not be copied or distributed without prior written approval from the firm. Statements are correct as of the date of the material only. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. The information in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified by Mellon. Mellon makes no representations as to the accuracy or the completeness of such information. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance. The indices referred to herein are used for comparative and informational purposes only and have been selected because they are generally considered to be representative of certain markets. Comparisons to indices as benchmarks have limitations because indices have volatility and other material characteristics that may differ from the portfolio, investment or hedge to which they are compared. The providers of the indices referred to herein are not affiliated with Mellon, do not endorse, sponsor, sell or promote the investment strategies or products mentioned herein and they make no representation regarding the advisability of investing in the products and strategies described herein. Please see mellon.com for important index licensing information.